What is energy flexibility?

In simple terms, flexibility describes our ability to adjust the way we use energy in response to signals from the grid, balancing system and wider market. There are two main use cases for this type of demand response – firstly, shifting demand up or down to meet generation and network capacity or secondly, shifting demand to times when energy is cheaper and networks are less overloaded.

Why energy flexibility matters for the UK?

Flexibility has always been crucial to grid services, although its importance has grown in recent years. Historically, fossil-fuel stations were highly flexible, being able to provide dispatchable energy by ramping output up or down in response to the grid and holding additional spinning reserve, effectively delivering flexibility as a by-product of generation.

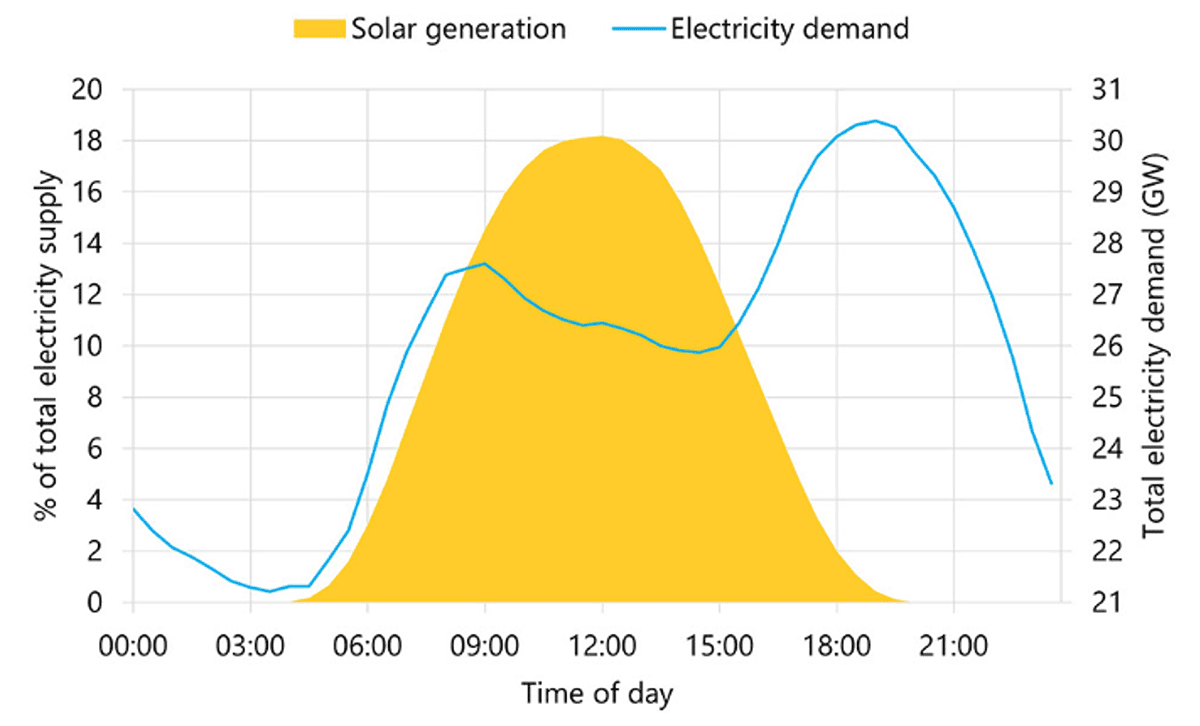

Synchronous generators used for gas and coal-fired plants provide inertia by using their heavy spinning rotors to steady the system, which slows sudden frequency swings and buys time for other flexible resources to respond. As gas generators are being replaced by renewables, this flexibility is being lost as solar and wind can’t be dispatched on demand and lack inherent inertia. An example of this mismatch between intermittent renewable generation and electricity demand can be seen in Figure 1, illustrating how solar generation peaks around midday while electricity demand rises in the evening.

We have now started to generate flexibility services separate to power, where demand response has become its own product by creating a unique value stream and market. In practice, that means selling services that provide speed, control and dispatchability rather than just electricity. Contracts for flexibility services are often agreed separately from electricity supply, covering products such as frequency response, reserve, inertia, and voltage support. Currently, flexibility is used for national balancing, systems operability and to manage network constraints.

How energy flexibility creates value?

Energy has always been valued in £/MWh terms but it has become increasingly clear that not all megawatt-hours are equal. A “firm” MWh that can be shifted or delivered exactly when needed is more valuable than an “inflexible” MWh that is only available during hours of solar generation.

This differentiated cost structure between energy generation and flexibility explains why new balancing assets, for example battery energy storage systems, earn revenue from stacking services – in addition to selling energy. A typical flexibility market stack includes:

- Frequency response is the fastest service, delivered within seconds to keep the system stable at 50 Hz. With fewer fossil plants on the system, batteries and other assets are now essential in providing this ultra-fast balancing.

- Reserve and re-dispatch provide a backstop when there are shortfalls or unexpected events, ensuring that the grid can recover quickly from a fault or sudden change in supply.

- The balancing mechanism is NESO’s real-time tool for adjusting supply and demand every half hour, using a mix of generators, storage, and demand-side participants.

- Voltage support and inertia are about maintaining the physical stability of the grid. Traditionally provided by synchronous machines, these services are now being replicated by technologies like grid-forming inverters and advanced batteries.

- Congestion management is typically procured by Distribution System Operators (DSOs) to address local constraints on networks, where reinforcement would otherwise be costly or delayed. NESO also uses the Balancing Mechanism to manage congestion on the transmission network.

- Energy arbitrage is where storage and flexibility providers buy electricity when it’s cheap (often during periods of high renewable output) and sell or shift consumption when prices rise, creating both a commercial opportunity and system efficiency.

These services are structured in a way that incentivises most UK grid-scale batteries to be sized for 0.5-2 hours of duration, which is long enough to capture the value frequency whilst maintaining strong economic performance. This trend is shifting, with new projects being developed specifically to enhance grid stability. Scotland’s largest battery, Blackhillock, has been designed with grid-forming inverters that provide synthetic inertia and voltage support. This speaks to a wider systems shift being pushed by NESO – who have been running a programme called the ‘Stability Pathfinder’ to procure non-synchronous stability, with Blackhillock being one of the flagship projects2.

This evolution demonstrates how flexibility has matured into a distinct asset class. Investors now model projects not just on power output but on stacked flexibility revenue streams. For system operators, flexibility has become an essential procurement category, almost as important as generation itself. For corporates, it represents a new opportunity to monetise assets, hedge energy risk, and contribute to a more resilient net-zero electricity system.

Scaling Flexibility: Insights from the Clean Flexibility Roadmap

The roadmap sets out ways that the UK will triple flexibility by 2030, with actions across five areas:

- Consumer-Led Flexibility: Expected to grow from 2.5 GW in 2023 to 10–12 GW by 2030, driven by smart tariffs, EVs, and heat pumps. EV fleets with vehicle-to-grid charging are central here, allowing day-to-day assets to discharge onto the grid.

- Grid-Scale Storage: Targeted to reach 23–27 GW by 2030, increasing almost 5-fold from 5 GW today. Planning and connection reforms are being introduced to accelerate deployment.

- Long-Duration Energy Storage: At least 4–6 GW of storage and up to 7 GW of low-carbon dispatchable power needed by 2030, driven by a new cap-and-floor model.

- Digitalisation: Frameworks for registering and tracking distributed assets, ensuring even small-scale devices can be visible and active in markets.

- Governance & Reform: Coordinated action between DESNZ, Ofgem and NESO, supported by new roles like a ‘Flexibility Commissioner’ and annual progress reviews.

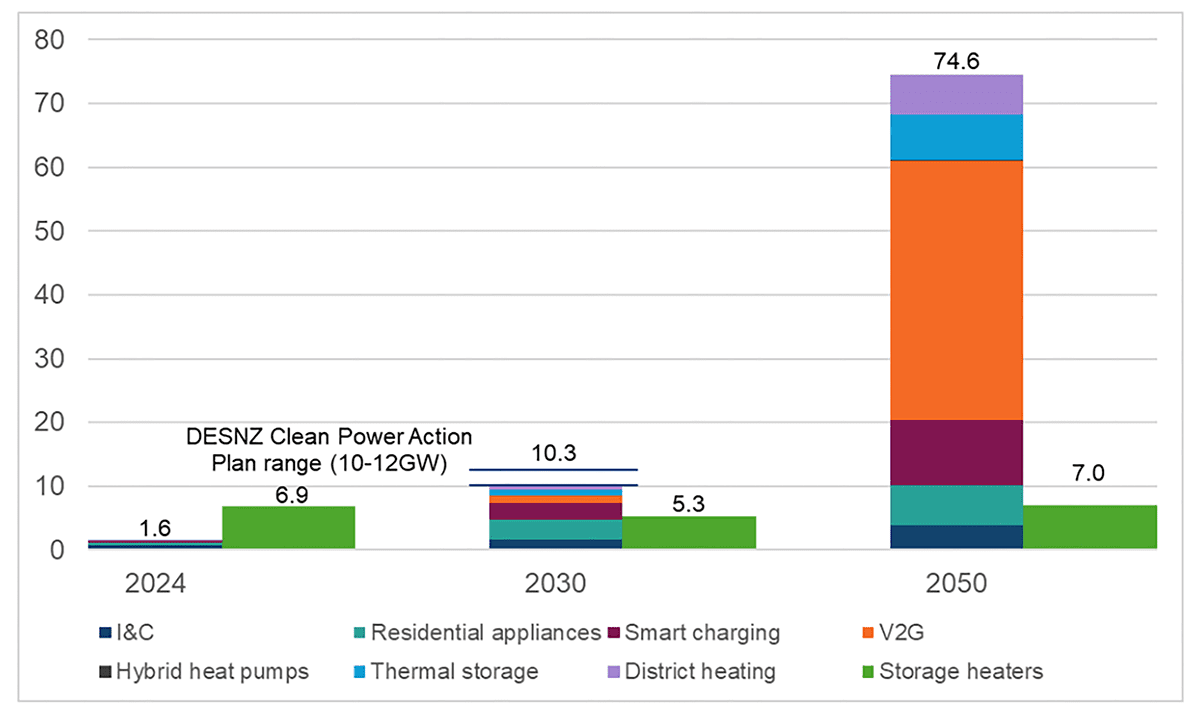

The figure below illustrates how consumer-led flexibility is expected to evolve under the clean flexibility roadmap. Currently, energy grid services provided by households and businesses are low, with contributions coming primarily from heat pumps, industrial demand and small amounts of smart charging. By 2030, capacity is projected to reach 10-12 GW – in line with roadmap targets – as EVs, V2G services and thermal storage begin to scale. Looking further ahead to 2050, the chart shows a step change where consumer-led sources such as V2G, smart charging, storage heaters and thermal storage could provide over 70 GW of peak flexibility.

Why energy flexibility matters for corporates

For businesses, flexibility has shifted from being a nice-to-have add-on to a core part of risk management and long-term planning. It’s becoming an increasingly important part of cost control in the energy system.

Managing costs and hedging risk

The energy price shocks we’ve seen in the past five years have emphasised how quickly volatility can impact supply chains and balance sheets. By engaging in energy service markets, businesses can protect themselves against these swings.

Building resilience

Certain sectors can’t afford to have any off-grid time that might be caused by lack of flexibility services or grid congestion. Data centres, which have traditionally relied on diesel generator redundancy to guarantee uptime, are now under pressure to transition to battery-based systems that can provide both backup power and grid balancing services. When the recent fire near Heathrow disrupted grid supply and airport operations earlier this year, several centres kept running on battery systems – highlighting how flexibility and resilience are increasingly interdependent.

Unlocking new revenues

Companies with EV fleets, on-site batteries, or flexible industrial processes are finding that these assets can generate income when paired with an aggregator. For some, flexibility helps reduce overall energy costs but, for others, it’s developing into a distinct revenue stream.

Navigating a complex market

The flexibility market is made up of multiple, overlapping services. At the national level, NESO buys frequency response, reserve, and balancing services to keep the system stable. At the local level, DSOs procure flexibility to relieve congestion and manage network constraints. Additionally, corporations can now participate directly in wholesale markets, using grid services to reduce their own imbalance exposure.

This fragmented landscape can be difficult to navigate, which is why many businesses partner with aggregators such as Centrica or Octopus, who bundle multiple services and market routes. Yet the more corporates understand how flexibility is valued and where their assets fit within the system, the better positioned they are to secure fair agreements with aggregators and incorporate flexibility into their wider energy strategy.

Flexibility is its own infrastructure

The transition to 100% renewable power will be decided not just by how much generation the UK builds, but by how well it deploys flexibility. The examples are already visible: large grid-forming batteries in Scotland providing inertia, data centres shifting from diesel to battery storage for resilience and households beginning to respond to dynamic tariffs. These developments show flexibility becoming a core element of grid infrastructure rather than a by-product of fossil generation.

Scaling flexibility will be challenging as the frameworks and markets are in place but investment and market participation still need to expand. For corporates, the growing flexibility market creates a strategic opportunity to cost-control, achieve sustainability targets and add new value streams. Those who are the earliest adopters of flexibility services will benefit from emerging energy markets and subsequent revenue. For consumers, it’s an opportunity to reduce bill costs while supporting a more stable grid. For the wider system, it allows renewables to be integrated securely and cost-effectively.

FAQ:

- What is energy flexibility?

Energy flexibility is the ability to adjust when and how electricity is used or generated in response to signals from the grid. For example, shifting demand up or down to meet generation and network capacity or shifting demand to times when energy is cheaper and networks are less overloaded. - How is energy flexibility different from energy storage?

Energy storage is a tool that can be used to provide flexibility on the grid but flexibility can also be provided by demand shifting e.g running industrial processes at off-peak times when the grid is less overrun. Storage and flexibility are not the same thing. Storage holds electricity for discharge at a later timepoint, whereas flexibility is the broader ability to alter demand or supply. - What does energy flexibility mean for UK businesses?

For businesses, flexibility offers lowers energy costs, reduced carbon emissions and new revenue opportunities. By shifting electricity consumption to off-peak times or by participating in flexibility markets, companies can reduce their bills whilst lowering their carbon footprint. - Why is energy flexibility important for the UK energy grid?

As the UK increases renewable energy production, flexibility is essential for maintaining system stability. It allows demand to shift in response to variable wind and solar output and enables stored energy to be discharged back onto the grid at later timepoints. This reduces reliance on fossil fuels, helps to manage grid congestion and lower electricity system costs. - How can companies make money from energy flexibility?

Businesses can earn revenue by providing flexibility service to the grid through demand-response programmes, selling excess stored energy or allowing assets like EV fleets or batteries to participate in balancing markets.

References:

- British Gas (2025) Harnessing renewable energy with demand flexibility. Available at: https://www.britishgas.co.uk/the-source/making-a-difference/harnessing-renewable-energy-with-demand-flexibility.html

- Zenobē (2025) Blackhillock: Europe’s largest grid‑scale battery. Available at: https://www.zenobe.com/case-studies/blackhillock-battery-scotland/

- Department for Energy Security and Net Zero (2025). Clean Flexibility Roadmap: Mapping the path to a clean, flexible, consumer-focused electricity system. July. Available at: https://assets.publishing.service.gov.uk/media/68874ddeb0e1dfe5b5f0e431/clean-flexibility-roadmap.pdf

Graham Oakes is the founder of Upside Energy, acquired by Octopus Energy, and winner of Shell Springboard and Ashden Awards. Specialist in AI-driven flexibility platforms for the energy transition. Former Chief Scientist and Chair at Upside, with contracts secured from National Grid and EDF. Systems engineer with deep experience across tech and non-profits incl. Cisco, Oxfam and Council of Europe. Chartered Engineer with PhD from Imperial and author of Project Reviews, Assurance and Governance.

Written by