The renewables challenge

As the global energy system transitions away from fossil fuels, wind and solar have emerged as critical power generation technologies. Despite grid penetration of renewables reaching a record 50% in the UK last year, generation is still just one part of the larger grid challenge1. For the energy grid to supply electricity that is both stable and dispatchable, the UK is still highly dependent on gas peaking plants to balance supply and demand during energy peaks, troughs and during periods of bad weather. During these periods, renewable generation alone can’t respond quickly enough to the daily needs of the grid.

Equally, when renewables generation is particularly high, on days with either an abundance of sunshine or wind, renewable electricity can exceed the grid’s transmission limits and frequency. This leads to renewables curtailment, where grid operators will deliberately restrict electricity generation from renewables and allow gas operators to bid into the system to make up the shortfall. Curtailment is a significant issue, adding over £800 million to energy bills in the UK each year2. The most obvious solution for preventing curtailment is to have long-term storage facilities co-located at renewable generation sites. It is estimated that renewables could operate at 90-95% capacity, if the UK were to have sufficient energy storage solutions in place3.

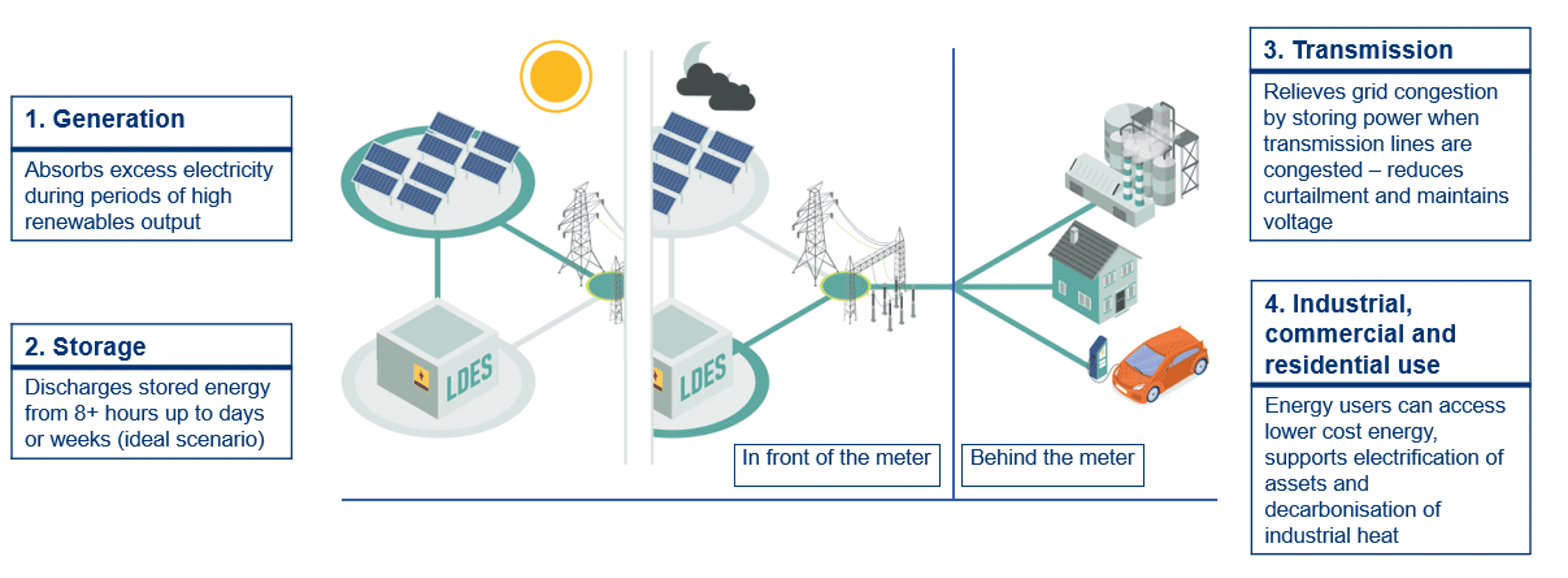

This is where long-duration energy storage (LDES) comes into debate, often thought of as one of the best ways to address both grid and storage challenges by storing energy for periods of over 8 hours and up to several days or weeks. However, in practice, LDES technologies face major hurdles and project developers are often met with high upfront capital costs that disincentivise private investment.

This article explores the emerging role of LDES in the UK’s clean energy transition – why it’s needed, what’s holding it back and what needs to change for it to replace gas . To date, the UK has installed 2.8 GW of LDES capacity – with the majority of this coming from four location-dependent pumped hydro plants. However, the National Energy Systems Operator (NESO) estimates that the electricity system will need 11.5-15.3 GW by 2050, in order to meet electricity demands and wider decarbonisation targets4. The variety of LDES use-cases across the energy system can be summarised in the figure below.

A closer look at our energy requirements

Modern power systems require a precise balance between supply and demand, often in real time. To balance the UK grid frequency at 50 Hertz, NESO manages a Balancing Mechanism which corrects shortfalls or oversupply in 30-minute intervals. Typically, when the frequency is mismatched, gas operators will bid into the balancing mechanism to generate electricity. The key issue is that, whilst renewables reduce the carbon intensity of the grid, they don’t provide dispatchable power – which is where storage solutions are required. This combination of renewables co-located with LDES may offer a route to energy security and sovereignty that can’t be achieved with other technologies.

Why LDES matters

Long-duration energy storage refers to technologies that can store energy for more than 8 hours and release it when needed, enabling true load-shifting over daily or even multi-day timescales. Unlike Battery Energy Storage System (BESS) solutions, which are effective for short bursts (1–4 hours), LDES technologies are designed to support the grid during extended lulls in generation – such as overnight, during wind droughts, or across seasonal mismatches.

The value-add LDES brings to the UK grid includes:

- Decarbonising grid stability: Replacing gas-fired balancing with clean alternatives.

- Enhancing renewable utilisation: Capturing excess wind and solar instead of curtailing it.

- Improving energy security: Creating a more resilient and independent grid.

The emerging tech landscape: what’s out there?

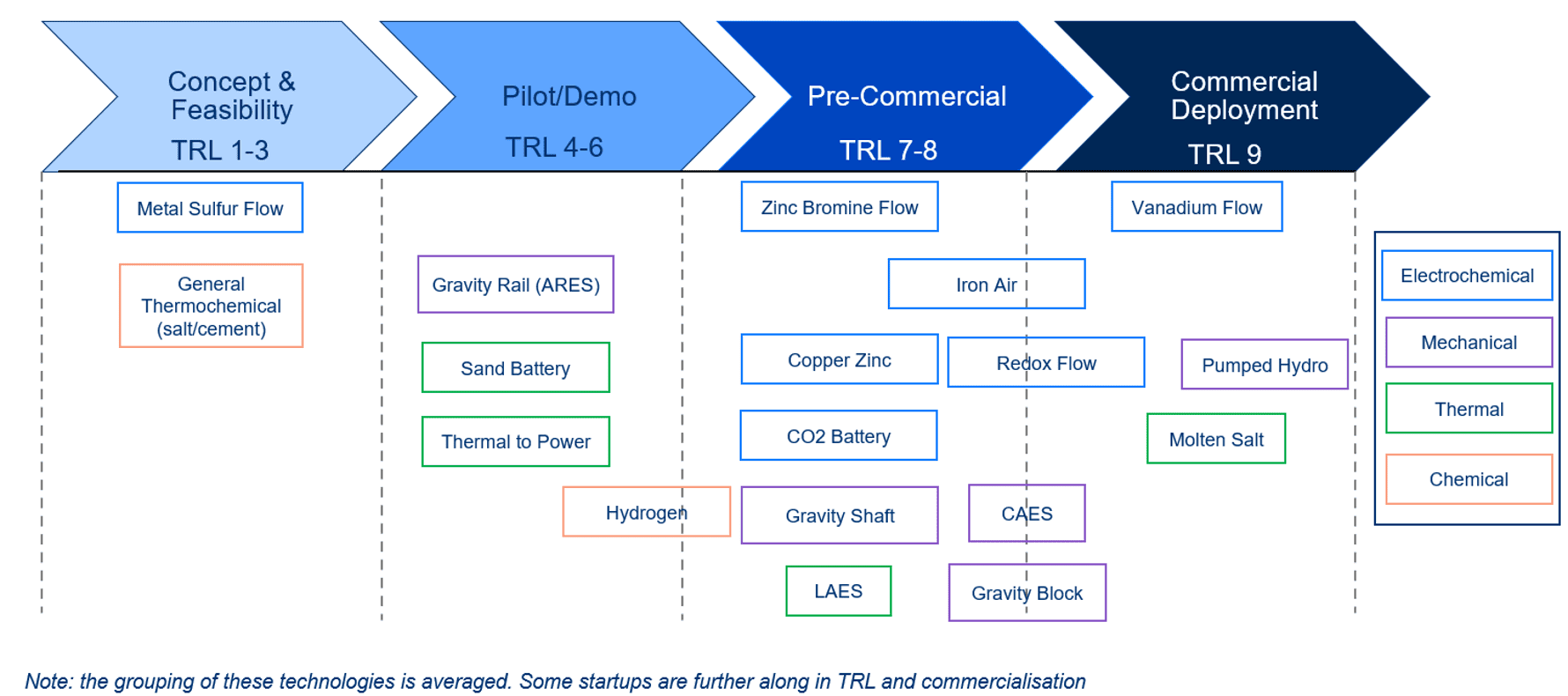

LDES is not a single technology but an umbrella category covering a large range of electrochemical, mechanical, thermal and chemical solutions. Different companies have developed these to varying levels of maturity, with some concepts still in the early lab-scale stage but others being commercially deployed. Figure 2 maps a range of LDES technologies against their Technology Readiness Level – from concept and feasibility (TRL 1-3), through pilot and demonstration projects (TRL 4-6), into pre-commercial trials (TRL 7-8) and finally full commercial operation (TRL 9).

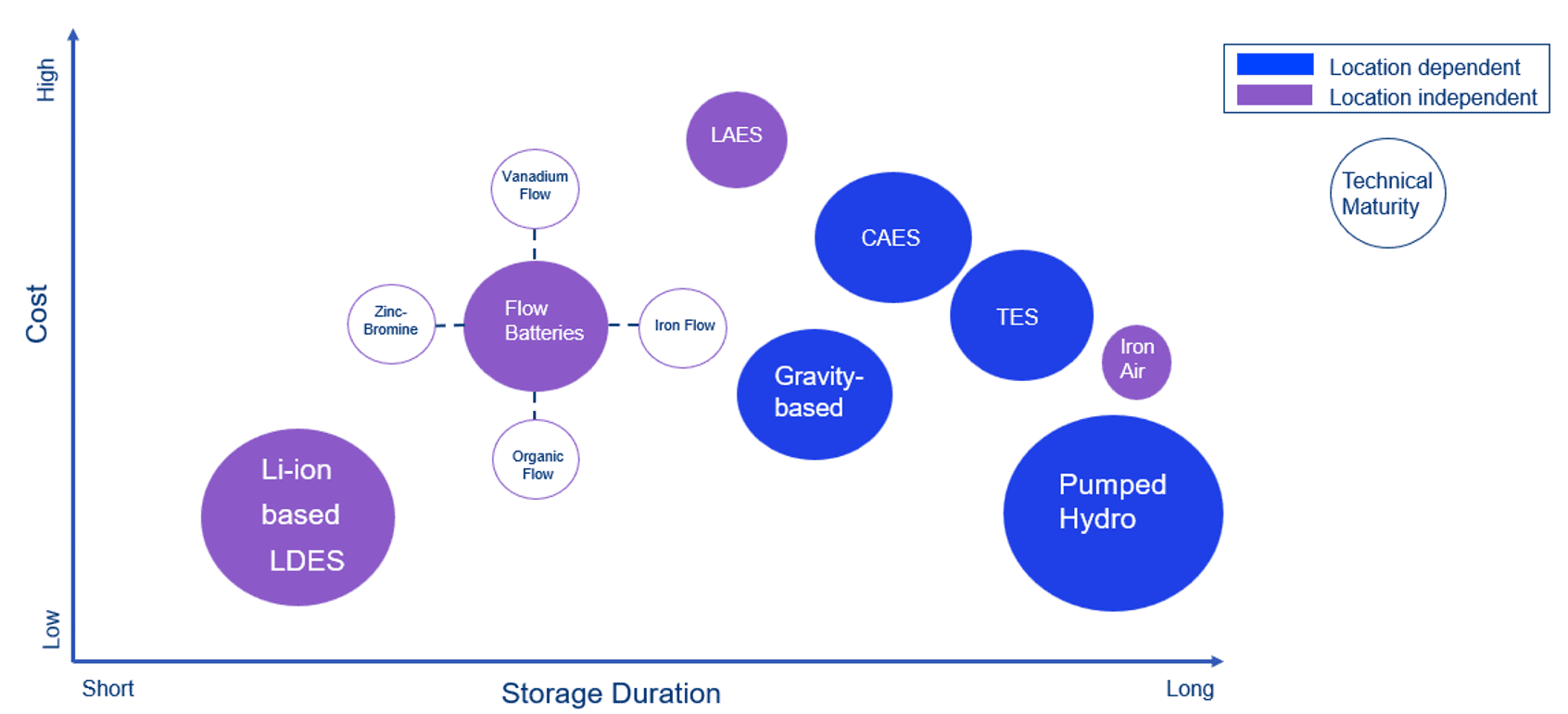

Each technology competes not only on technical maturity but also on cost, scalability, siting requirements and supply chain resilience. A comparison of how these technologies perform on cost versus storage duration can be found in Figure 3. Li-ion has been included as a reference point to highlight its current market dominance on a cost basis.

Why isn’t LDES already scaling?

Across the UK, very few innovations in the LDES space – beyond pumped storage hydro- have progressed beyond scale-up stage. Globally, progress is moving slightly faster, with large demonstration and early commercial projects already operating in markets such as China, North America and Australia. China leads the field in grid-connected LDES batteries, hosting the world’s largest compressed air energy storage facility and now starting to advance a range of other long-duration technologies.

There are three main reasons for slower progress in the UK:

1. Technical and Operational Barriers

While many LDES concepts work in lab settings or pilot projects, few have been validated at grid scale over long periods. The challenge isn’t inventing the tech – it’s engineering it to deliver reliable, repeatable performance across 10+ years, in real-world conditions.

Discharge duration is a particular constraint with most current systems capping out at 8–10 hours, limiting their usefulness for multi-day balancing or “dunkelflaute” (low-wind) events. In addition, certain technologies face restrictions on where they can be deployed. For example, thermal storage systems require co-location with a consistent and suitably profiled heat demand, which can severely limit siting flexibility and reduce their applicability in regions where such demand is seasonal or absent.

2. Economic Hurdles

LDES must compete with existing solutions – not just on a cost per kWh basis, but in terms of value delivered. Gas remains cheap and abundant, especially in deregulated markets with no carbon floor, and without long-term contracts or capacity payments, most LDES projects can’t achieve bankability.

3. Policy and Market Design

Today’s electricity markets don’t reward long-duration storage – in the US, capacity market credits are awarded at 4 hours. Capacity mechanisms, ancillary service markets, and balancing auctions are designed around short-term assets – with studies showing that the first 4 hours of storage provide the majority of available time-shifting value. Analysis by the National Renewable Laboratory in the US found that 4-hour devices can capture more than 60% of the ancillary market value obtained by a 40-hour storage device6. In the UK, the proposed cap-and-floor mechanism aims to address some of these gaps by guaranteeing a minimum revenue for LDES projects and ultimately longer-term investor certainty.

Limitations to lithium-ion

Lithium-ion batteries are the market leader of today’s energy storage landscape. Their plummeting costs and strong performance in 1–4 hour ranges have made them the default option for grid and behind-the-meter storage.

But lithium-ion has limitations when it comes to:

- Discharge duration beyond 4–6 hours

- Degradation over frequent cycling

- Thermal management risks at scale

- Resource constraints, particularly lithium, cobalt, and nickel

Lithium-ion is ideal for short durations, but it also unlikely to solve the deep decarbonisation challenge on its own.

Where the UK stands and what needs to change

The UK has made significant progress on renewable deployment but is now entering a harder phase of the transition where it must replace flexible fossil fuels.

The UK’s investment environment for long-duration energy storage remains cautious and risk-sensitive. Although policy momentum is growing through the cap-and-floor mechanism, the proposed outline has been met with industry backlash. The mechanism is intended to provide investors with greater revenue certainty by setting a minimum guaranteed return (the floor) and a maximum allowable return (the cap). In principle, this could help de-risk capital-intensive LDES projects and encourage deployment. However, the current design has attracted criticism for a lack of clarity over how returns will be calculated, overly restrictive conditions that could limit project flexibility, and an apparent failure to account for the unique operational profiles and system-wide value that long-duration storage can deliver.

Additionally, owners of short-duration battery energy storage systems (BESS) have cited fears that the mechanism risks creating a two-tier market. They state that targeted support for LDES could distort competition, reduce incentives for innovation in short-term storage, and potentially undermine the economic case for assets that currently provide the bulk of the UK’s grid-balancing services. Without adjustments to address these concerns, there is a risk that the policy could slow investment across the broader storage ecosystem rather than accelerate it.

To unlock the LDES potential, the UK needs:

- Stronger carbon pricing or carbon floors

- More detailed guidance on the cap and floor mechanism – to provide investor confidence

- Pilot and demonstration grants to de-risk early deployments over a longer time frame

- Strong signals from National Grid ESO and DESNZ on the long-term benefits of LDES in system planning

What comes next?

Long-duration energy storage sits at a critical junction where the systems need is urgent but the path to scale remains unclear.

To shape the future of grid storage, organisations should:

- Monitor the LDES landscape closely – technology maturity is uneven but accelerating.

- Engage early with innovators – strategic partnerships can unlock first-mover advantages.

- Factor grid flexibility into investment models – duration is becoming a differentiator.

- Advocate for fair market design – duration and dispatchability deserve compensation.

- Push for policy innovation, not just tech innovation – especially in procurement frameworks and capacity market design.

References:

- National Energy System Operator (NESO). Britain’s Electricity Explained – 2024 Review. Available at: https://www.neso.energy/news/britains-electricity-explained-2024-review

- Drax Group & LCP. Renewable Curtailment Report. Available at: https://www.drax.com/wp-content/uploads/2022/06/Drax-LCP-Renewable-curtailment-report-1.pdf

- UK Department for Energy Security and Net Zero (DESNZ). Long-Duration Electricity Storage: Scenario Deployment Analysis. Available at: https://assets.publishing.service.gov.uk/media/659be546c23a1000128d0c51/long-duration-electricity-storage-scenario-deployment-analysis.pdf

- National Energy System Operator (NESO). Pathway to 2035 – Second Iteration. Available at: https://www.neso.energy/document/364541/download

- Evesco: Behind the meter vs front of the meter – https://www.power-sonic.com/blog/behind-the-meter-vs-front-of-the-meter/

- National Renewable Energy Laboratory (NREL). Moving Beyond 4-Hour Li-Ion Batteries: Challenges and Opportunities for Long(er)-Duration Energy Storage. Golden, CO: NREL Technical Report NREL/TP-6A40-85878, September 2023. Available at: https://www.nrel.gov/docs/fy23osti/85878.pdf

Written by