High upfront capital expenditure (CapEx) has long been one of the central barriers to corporate adoption of innovative clean technologies. Whether it’s industrial heat pumps, recycling infrastructure, or energy storage systems, the cost of procuring, installing, and maintaining these assets can delay or permanently derail investment in net-zero solutions. However, innovative businesses models like Assets-as-a-Service (AaaS) can break these capital deadlocks.

What is Asset-as-a-Service?

At its core, Asset-as-a-Service is a financing and ownership model where the customer does not purchase an asset outright, but instead pays a recurring fee for its use or, more commonly, the outcomes the asset delivers. The technology developer itself, not the buyer, is therefore responsible for its performance and maintenance. This transforms capital expenditures (CapEx) into operational expenditures (OpEx), which reduces financial risk for the end user and creates a more flexible, scalable route to adoption.

In cleantech, the “asset” might be a heat pump, solar array, or bio-based chemical dosing system, but in AaaS models, what’s being sold is performance or outcomes. Hence why we see language such as “Heat-as-a-Service” or “Energy-as-a-Service”.

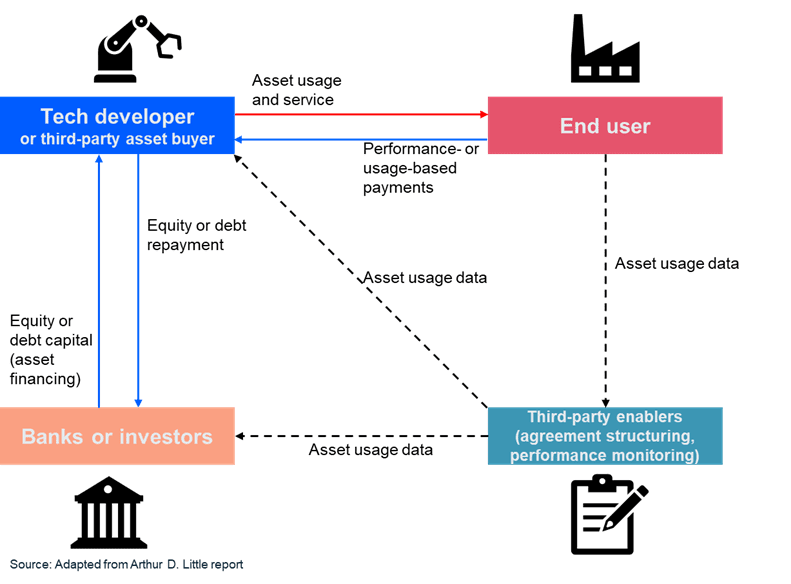

Figure 1: An overview of AaaS business models1

The technology provider (either the technology developer themselves or a third party) retains ownership and responsibility for monitoring, maintaining, and optimising the asset. This means the risk of underperformance or technical failure remains largely with the supplier.

Why does this matter for corporates?

AaaS models deliver benefits that resonate across corporate procurement, finance, and sustainability teams:

- No Large Upfront Cost: Deferred capital outlay enables swifter decision-making and uptake, especially in budget-constrained organisations or those with strict internal hurdle rates.

- Performance Accountability: Since payments are often tied to KPIs (e.g. energy saved, tonnes of material processed), the burden of delivery shifts to the provider.

- Asset-light Strategy: Companies can trial innovative technologies without long-term lock-in, which is particularly important in sectors with fast-moving technical change.

- Improved Financial Ratios: Assets provided “as a service” do not appear as liabilities or capital assets on the balance sheet, improving return on assets and debt-to-equity ratios.

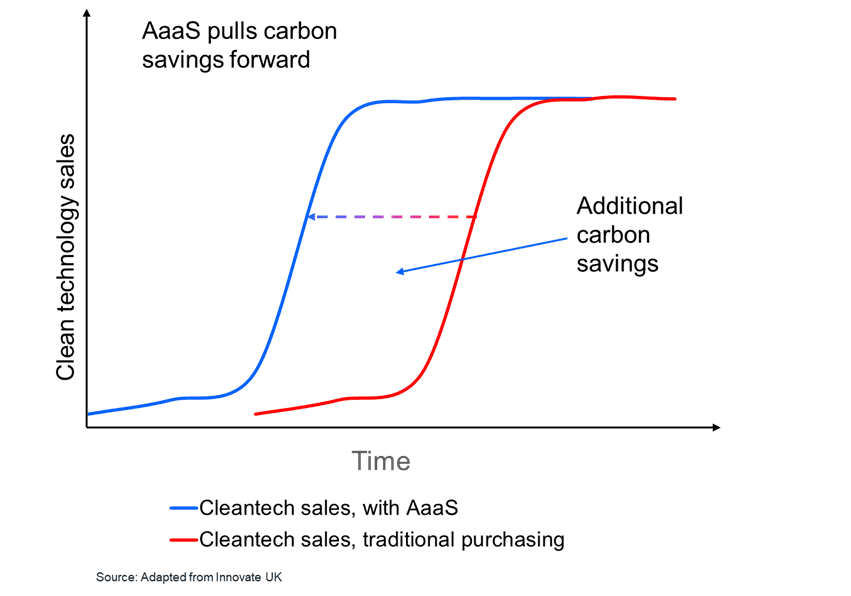

These benefits accelerate major asset decision making time by the saved risk. The result is a quicker deployment of key decarbonisation assets (a.k.a. clean technologies or cleantech) in use that will reduce emissions. This saved time directly translates to tangible energy and emissions savings.

Figure 2: AaaS models accelerate decarbonisation2

The effects of AaaS on the end-user’s balance sheet

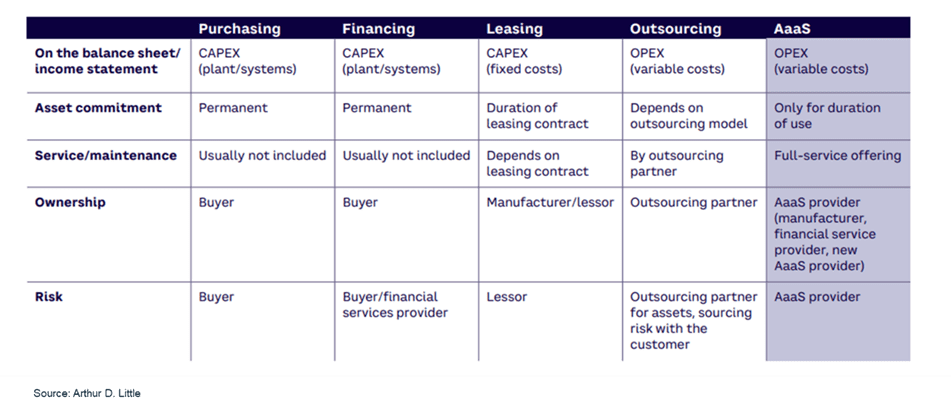

AaaS is the only financing model that lets companies treat costs as OpEx while still operating the asset themselves and on-site; this not only avoids high up-front costs, but can significantly affect investor confidence by improving valuation ratios. Short-term leasing may also qualify as OpEx, but it’s rarely practical for large, capital-heavy decarbonisation equipment like industrial heat pumps.

Figure 3: The primary archetypes for financing an asset1

The CapEx versus OpEx distinction has a major impact on a company’s financial profile.

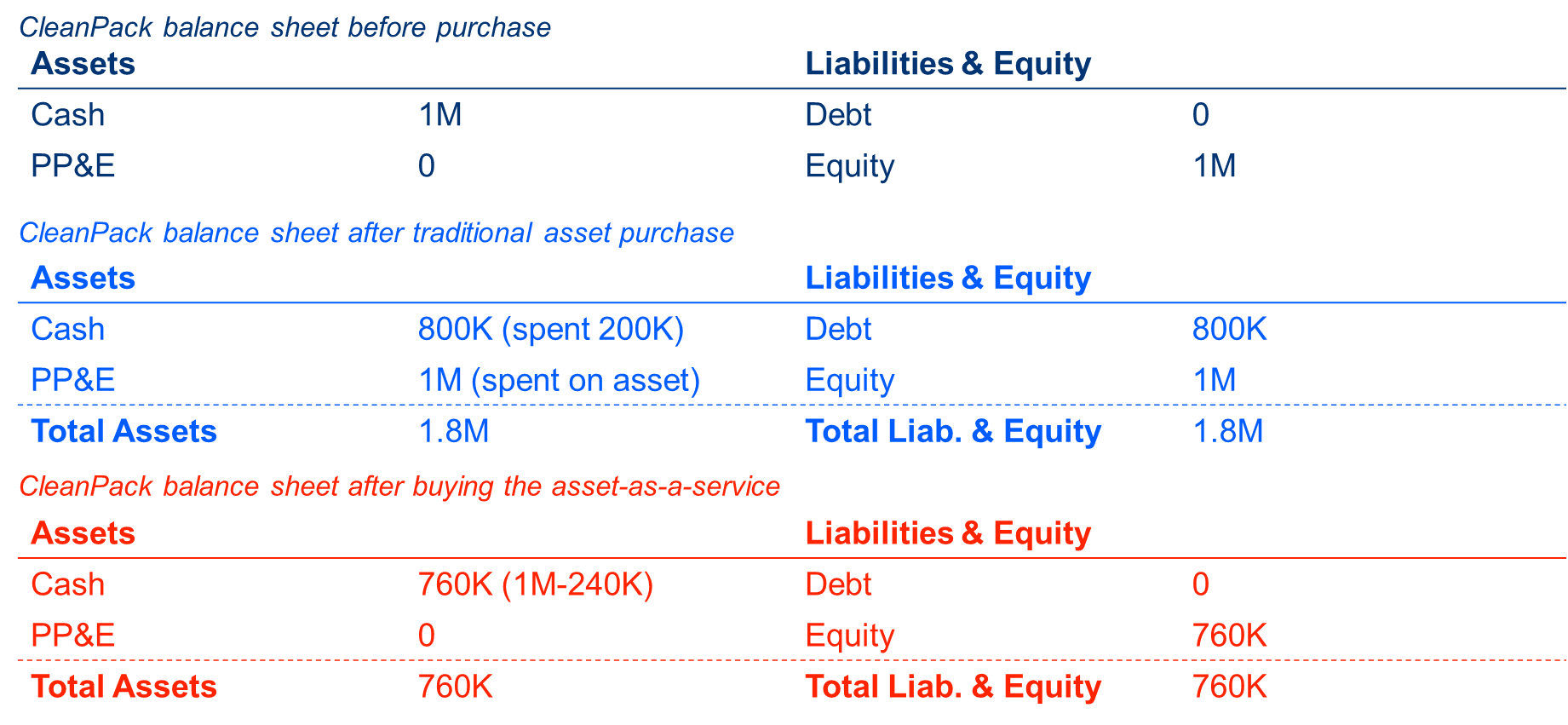

Take a simple example: CleanPack Ltd has £1M in cash and needs to acquire a plastic recycling machine worth £1M outright. For expository purposes, let’s say CleanPack currently has no other assets or liabilities, and we’ll use shareholder equity (£1M initially) to balance the right side of their balance sheet.

To acquire the machine, CleanPack can either:

- Buy the machine for £1M using £800K of debt and £200K of cash, or;

- Pay £240K per year via an AaaS model, with no upfront cost

The balance sheet before and after both scenarios is shown below.

Figure 4: Hypothetical balance sheets before and after both traditional purchasing and AaaS

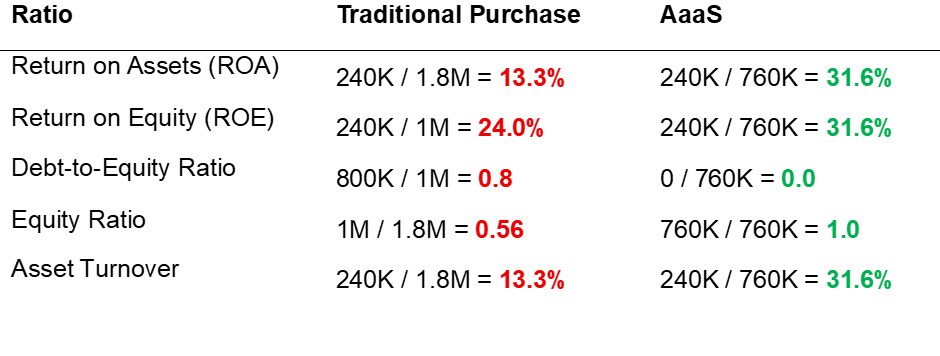

Immediately, key valuation ratios, such as return on assets, debt-to-equity, asset turnover, etc., all improve under the AaaS model. It keeps the company asset-light even when deploying heavy infrastructure needed for circular, low-carbon operations, by shifting performance and maintenance responsibilities on the technology developer, or other third parties who underwrite the AaaS agreement.

Figure 4: The impact of AaaS on key valuation ratios

So why isn’t AaaS happening more?

Despite the appeal, uptake of AaaS models remains limited in cleantech. There are several structural hurdles:

- Capital Intensity for Providers: Clean technologies like heat pumps or carbon capture units are expensive to produce. Startups or even growth-stage manufacturers often lack the balance sheet to retain ownership of the assets they build.

- Monitoring and Data Requirements: Outcome-based contracts require robust, often real-time, data on asset performance. Many industrial facilities lack the digitisation necessary to enable this.

- Legal and Commercial Complexity: Structuring long-term contracts that account for risk-sharing, asset return conditions, or performance variability adds friction to deployment.

- Cultural Inertia: Many industrial buyers are unfamiliar or uncomfortable with moving away from outright ownership models, especially for mission-critical infrastructure.

Surpassing these hurdles requires use-cases where the benefits are clear and obvious.

Who is the AaaS model best suited for?

AaaS isn’t a one-size-fits-all solution. It works best in specific contexts where the risks are manageable, the performance is measurable, and the commercial model makes sense. In particular:

- Technologies with Clear, Measurable Outcomes

Equipment that delivers quantifiable performance, e.g. kWh saved or tonnes recycled, makes it easier to structure performance-based contracts. - Slow-to-Move Industries

Where end users are cautious or conservative due to deeply entrenched systems or processes, third parties can step in to underwrite the asset and offer it as a service, helping de-risk adoption. - Flexible, Modular Technologies

Products like solar microgrids or certain thermal storage ‘heat batteries’ that can be removed and redeployed lend themselves well to the model. - Later-Stage Innovations (at scale-up phase)

AaaS is not suited to early stage innovators looking to pilot their technologies or gain early in-situ validation, in part due to the capital risk to the startup retaining ownership of the technology, and in part because the AaaS model requires stable and measurable outcomes to be effective. More developed innovations, at the “scale-up” phase or beyond, overcome this risk.

There are instances where some buyers are not suited for AaaS. Some corporates require guaranteed uptime and will not be suited to a model that shifts performance risk to the asset. Others operate in markets where asset payback periods are short, and outright ownership makes more financial sense.

Additionally, a corporate may require some amendments to a “standard” AaaS model. There are countless permutations of the basic AaaS model to unlock these benefits for a specific use case or business, but this requires detailed planning, and alignment from innovators, investors, and the corporate.

For early-stage startups, the model presents a paradox: it promises recurring revenue and risk ownership, but demands working capital and trust that many startups haven’t yet earned. In some cases, hybrid models, such as a two-year subscription followed by a buyout, could be a bridge.

What role does CLT play in bringing AaaS to life?

At Carbon Limiting Technologies, we believe AaaS models deserve serious consideration as part of the commercialisation toolkit. There are three areas where we can can help:

- Market Research

Identifying which market segments and specific technologies/start-ups are structurally suited to AaaS models, and where uptake is most likely to accelerate near-term decarbonisation. - Feasibility & Structuring

Deeper assessments of where AaaS models are viable based on payback periods, risk appetite, and monitoring requirements and capabilities. - Convening Stakeholders

Acting as a neutral facilitator between cleantech suppliers, financiers, and corporate buyers to design business models that work for all. We speak the language of all three.

Closing thoughts

AaaS is not a silver bullet, but for some technologies and sectors, it can unlock corporate demand that would otherwise remain stuck behind a procurement or CapEx bottleneck. It also encourages performance-oriented deployment, which aligns with net-zero goals.

As with many cleantech commercialisation levers, the challenge lies not only in the technology–but in the model. As we continue to support startups and corporates navigating the clean transition, we’ll be exploring how these models evolve, and what role we can play in making them investable, workable, and scalable.

To discuss how an Asset-as-a-Service model might support your company’s decarbonisation plans, get in touch at info@carbonlimitingtechnologies.com.

1See Arthur D. Little paper here: https://www.adlittle.com/sites/default/files/reports/ADL_Asset_as_a_service_1.pdf

2Adapted from Innovate UK material on Advance Market Commitments

Written by