Market Intelligence

Our market intelligence services provide real-time insights that sharpen cleantech investments decisions, aiding investors in staying ahead in the rapidly evolving cleantech landscape. We assess technology maturity and market fit, identify competitive positioning and potential market disruptions, and forecast regulatory and policy shifts. By translating data into actionable intelligence, we assist investors in pinpointing high-growth ventures with a genuine competitive advantage for cleantech investments.

Investment Evaluation

We also work closely with investors to develop robust portfolio strategies that balance risk with reward, ensuring alignment with financial objectives and sustainability goals. Our expertise spans investment thesis creation, innovative financing structures, and strategic ecosystem partnership strategies that create value chains to accelerate portfolio success. With a tailored investment strategy, we help funds capture first-mover advantage in emerging cleantech markets.

Comprehensive Evaluation

Beyond identifying opportunities, we ensure that investment targets possess both groundbreaking technology and viable commercial pathways. Our rigorous and comprehensive evaluation process includes validating business models, reviewing technical solutions, and refining value propositions to confirm market fit. Our route-to-market planning identifies optimal channels and partnership opportunities. This proprietary approach mitigates investment risk, enhances deal confidence, and strengthens negotiation positions.

Value Enhancement

Our post-investment process provides hands-on support to accelerate portfolio company growth and maximise returns. We work closely with founders to drive operational and commercial scale-up, develop performance analytics and value creation strategies, and optimise exit pathways. By ensuring that companies mature into market leaders, we help investors unlock long-term value. With decades of cleantech expertise and a track record of successfully guiding funds in identifying, structuring, and scaling high-value investments, we offer an end-to-end approach that de-risks portfolios and maximises growth potential. Partnering with CLT gives investors the confidence to deploy capital effectively, scale portfolio companies more rapidly, and lead the future of cleantech innovation.

Case Study Library

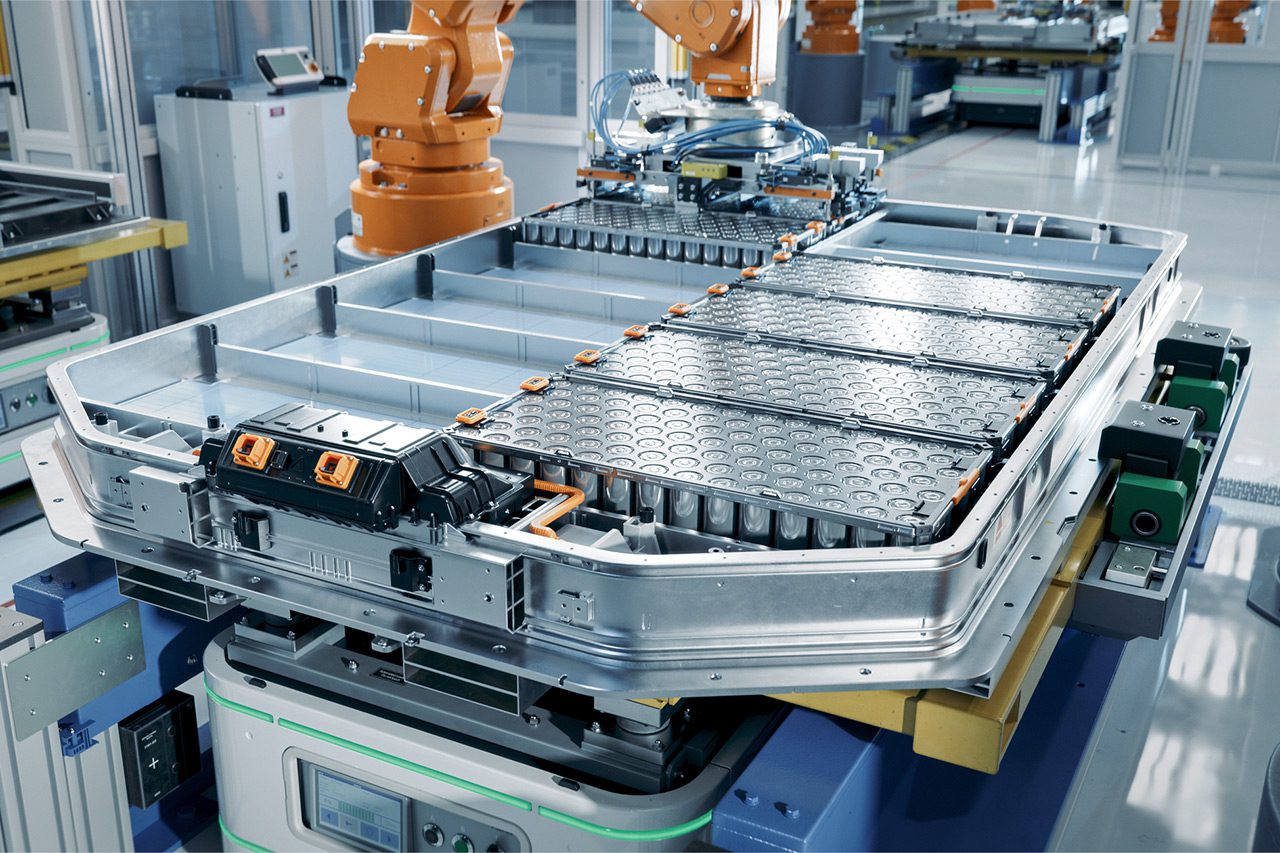

Mapping of UK Battery Innovation Landscape

Transport, Industrial and Commercial Refrigeration (TICR) decarbonisation pathways

Commercialisation of Sharp’s Hybrid Renewable Heating Solution

Developing Innovative Blended Finance Models to Accelerate Climate Tech Investment

Exploring Thermal Energy Storage in UK Heat Networks

Rare Earth Element Magnet Manufacturing

UKRI Innovation Ecosystem Events